Natural Diamond Prices are a tricky thing to figure out. Why do they cost what they do? There seem to be plenty of diamonds around. Why are they so expensive? These are questions that many consumers ask when after a trip to the jewelry store. And unfortunately, there isn’t really a good answer either.

Most of the diamonds and diamond mines in the world are owned by DeBeers. They are a family owned, very old, business that basically has a monopoly on the diamond business. Especially gem quality diamonds. So, they pretty much set the international Natural Diamond Prices on the wholesale level. They are able to do this by controlling the supply. They hoard gem quality diamonds to keep prices artificially high. It is a mystery why they haven’t been prosecuted for anti-truest violations, but that is another story.

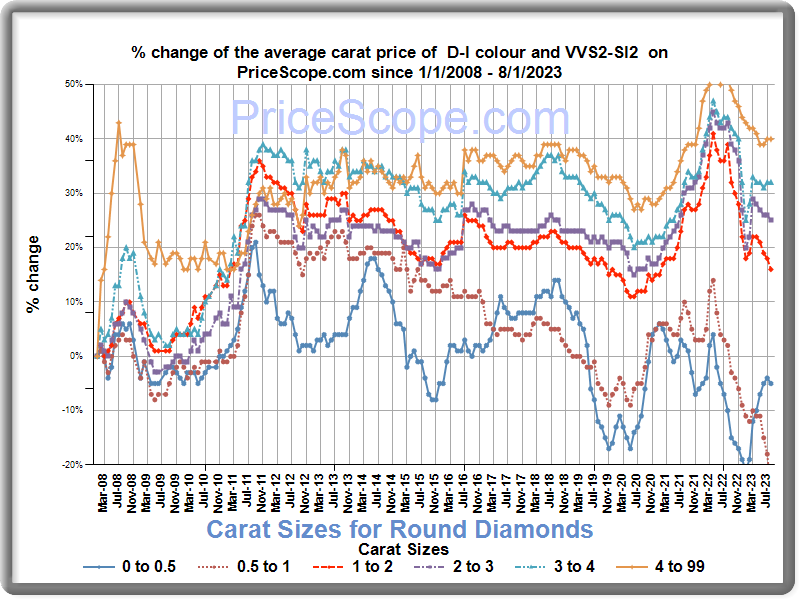

Consumer demand does play a small role in the price consumers pay. However, nowhere near as much as with a commodity such as oil. Today’s retail natural diamond market is highly competitive and consumers should be aware of possible price fluctuations when purchasing natural diamonds. That said, it is important to do your research before purchasing a large diamond. Tracking market trends when buying natural diamonds can help consumers make more informed buying decisions when buying a larger natural diamond.

More On Debeers

Debeers, the diamond mining and trading company, has a significant impact on natural diamond prices. Their actions, driven by their monopoly-like control over the diamond market, have the power to manipulate prices to their advantage. By carefully controlling the supply of diamonds and creating artificial scarcity, Debeers is able to maintain high prices and drive up demand. This not only benefits their own profits but also affects the entire diamond industry.

One of the key ways Debeers influences natural diamond prices is through their control over the diamond supply chain. They have a near-monopoly on diamond mining, owning mines in various countries around the world. This allows them to dictate the amount of diamonds that enter the market, ensuring that supply remains limited. By restricting the supply, Debeers creates a sense of scarcity, which in turn drives up prices. This strategy has been highly successful for them, as it allows them to maintain high profit margins and control the diamond market.

In addition to controlling the supply, Debeers also heavily influences consumer demand for diamonds. Through their marketing campaigns, they have successfully created a strong association between diamonds and love, making them a symbol of commitment and romance. Remember “A Diamond Is Forever”? They were also responsible for the idea that en engagement ring should cost 2 months salary. This clever marketing strategy has effectively ingrained the idea that diamonds are a necessary part of significant life events, such as engagements and anniversaries. As a result, the demand for diamonds remains consistently high, ensuring that prices remain inflated.

Debeers’ actions have a significant impact on diamond prices. Through their control over the diamond supply chain and their clever marketing tactics, they are able to manipulate prices to their advantage. While this benefits their own profits, it also affects the entire diamond industry, as consumers are forced to pay higher prices for these precious stones.

Natural Diamond Prices

But let’s not be too quick to judge. Debeers claims that their actions are necessary to maintain the value of diamonds and protect the industry. They argue that by carefully controlling the release of diamonds into the market, they prevent oversupply and ensure that diamonds remain a symbol of rarity and luxury. It’s a delicate balancing act, my friend, like walking on a tightrope.

However, not everyone is convinced. Critics argue that Debeers’ monopoly-like control over the diamond market allows them to artificially inflate prices. They argue that diamonds are not as rare as we think, and that Debeers’ tactics are simply a clever marketing ploy. After all, diamonds are just rocks, right? But hey, who am I to say? All I know is that when it comes to diamond prices, Debeers holds the cards, and we’re all just players in their glittering game.

Natural Diamond Prices

Diamond prices are influenced by a variety of market forces. One major factor is supply and demand. When the supply of diamonds is limited, prices tend to increase. On the other hand, if there is an oversupply of diamonds, prices may decrease. Another factor is the overall state of the economy. During times of economic growth, consumer confidence and purchasing power increase, leading to higher demand and potentially higher prices for diamonds. Conversely, during economic downturns, demand for luxury items like diamonds may decline, resulting in lower prices.

Additionally, changes in consumer preferences and trends can also impact diamond prices. For example, if a particular diamond shape or color becomes more popular, prices for those diamonds may rise. Lastly, the influence of marketing and branding cannot be underestimated. Companies that effectively market their diamonds as rare and exclusive can command higher prices. In conclusion, the market forces that affect diamond prices include supply and demand, the state of the economy, consumer preferences, and effective marketing strategies.

Round diamonds continue to be the most popular diamond shape on the market. They have an 80.88% (popularity), a 1.33% drop since May 2023. That top spot translates into round stones having the highest cost per carat. The oval has raised its popularity by 46.26%, rising to second most popular diamond shape. Emeralds increased by 56.55% in popularity, reaching third place. Surprisingly enough, the cushion cut dropped 35.64% in popularity, falling from second place to fourth place in 2022. The Radiant cut has dropped off the chart of the 5 most popular diamond shapes and has been replaced by Princess, which is currently in fifth place. Consequently, the princess cut demands the smallest price per carat in comparable stones.

Diamond Price Chart For Round Diamonds

| Round Diamond Price Changes For The Last 3 months | |||

| Diamond Carat Sizes | 5/1/2023 | 6/1/2023 | 7/1/2023 |

| 0.0 – 0.5 | 3 % ↑ | 2 % ↑ | 1 % ↑ |

| 0.5 – 1.0 | 0 % | -4 % ↓ | -3 % ↓ |

| 1.0 – 2.0 | -1 % ↓ | -2 % ↓ | -1 % ↓ |

| 2.0 – 3.0 | -1 % ↓ | -1 % ↓ | 0 % |

| 3.0 – 4.0 | 0 % | -1 % ↓ | 1 % ↑ |

| 4.0 – 99 | -2 % ↓ | 0 % | 1 % ↑ |

In July, the average price per carat for a round, G color, VS1 Clarity diamond from 1-1.19-carats was $8,437 compared with an average price of $7,921 for the previous month. The average round diamond price has has increased by 6.51% since May.

Natural Diamond Prices

These graphs and numbers are for prices in general. They don’t generally take into account the cut, polish, or symmetry. These specs can greatly add to the price of Natural Diamond Prices. For example, a 1 carat, G color, VS2 clarity round stone with good symmetry, polish, and cut can cost 30% less than a stone with triple excellent grades. Another thing to take into consideration is the seller. Is it a smaller, local, mom and pop store? Or, is it a national chain located in a mall or expensive shopping center? These two sellers can have wildly varying prices on comparable stones. This is because the chain store has far more overhead and sometimes offer free returns and stone upgrades. These services can significantly effect the price of a stone.

So, when shopping, check out ALL types of jewelers when looking to buy a larger diamond.

Diamond Attributes & Natural Diamond Prices

When it comes to natural diamond prices, there are several aspects of the diamond itself that play a significant role. First and foremost, the 4Cs – carat weight, cut, color, and clarity – greatly impact the value of a diamond. A larger carat weight, a well-cut diamond, a colorless or near-colorless stone, and a high level of clarity all contribute to a higher price tag. Additionally, the shape of the diamond can also affect its price, with round diamonds generally commanding a higher value compared to fancy shapes. Finally, the presence of any unique characteristics, such as fluorescence or fancy color, can further influence the price of a natural diamond. Overall, it’s important to consider these various aspects when determining the value of a diamond.

A diamond’s carat weight, cut, color, clarity, shape, and unique characteristics all impact its price. It’s essential to understand these factors when evaluating the value of a natural diamond. Whether you’re buying or selling a diamond, being aware of these aspects will help you make informed decisions and ensure that you’re getting the best value for your investment. So, next time you’re in the market for a diamond, remember to consider these key factors and choose wisely.

Give Us A Shot!

Whether you need a diamond ring, pendant, or earrings, we can help. We make custom jewelry. That is pretty much all we do. So, why not have a stunning custom jewelry creation created for the diamond you are thinking about? You can have something created just for you that shows your personality and sense of style. And it can be done almost as easily, if not easier, than going to the mall. Many times, it can cost less for something comparable from the chain stores.

We have a GIA graduate gemologist who can pick the best stone for your budget. And without the hassle of a pushy salesman with an agenda.

You can view our portfolio of custom engagement rings or custom pendants to look for ideas. Or you can contact us with your own idea.